Double declining method formula

Double Declining Balance Method formula 2 Book Value of Asset at Beginning SLM. This article describes the formula syntax and usage of the DDB function in Microsoft Excel.

Double Declining Balance Method A Beginner S Guide To Calculating Depreciation

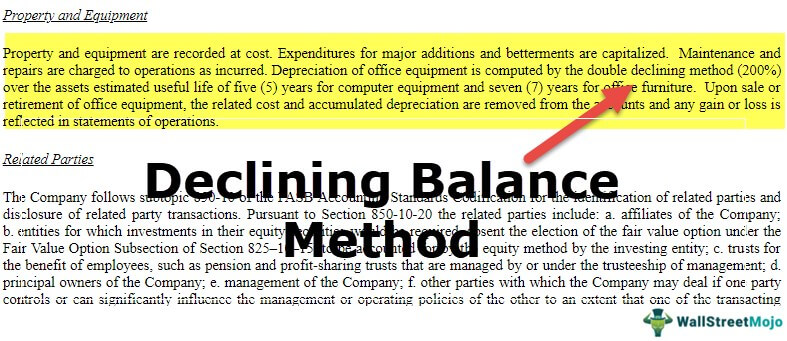

The DDB depreciation method is a little more complicated than the straight-line method.

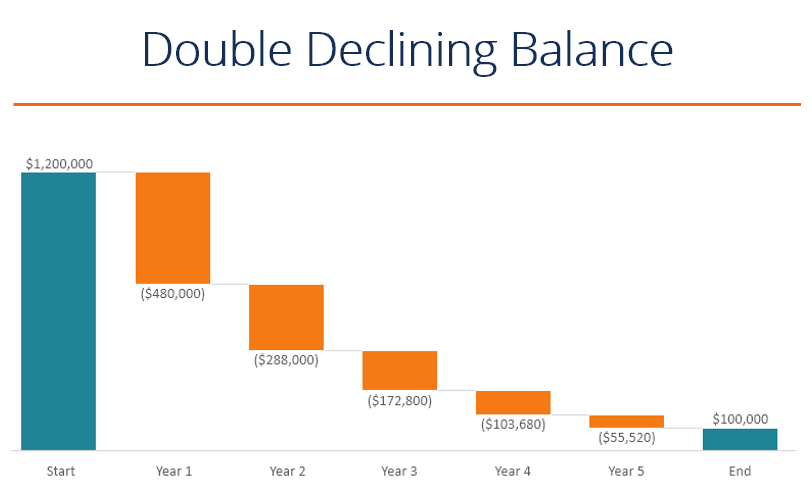

. Double declining balance is calculated using this formula. Heres the formula for calculating the amount to be depreciated each year. To implement the double-declining depreciation formula for an Asset you need to know the assets purchase price and its useful life.

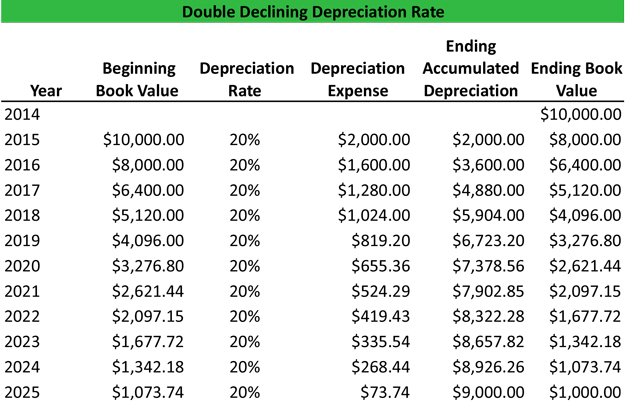

50 000 x 40. In other words the depreciation rate in the double-declining balance depreciation method equals the straight-line rate multiplying by two. Double Declining Balance Method formula 2 Book Value of.

The double declining balance is. While the total expense remains the same over the. The formula for depreciation under the double-declining method is as follows.

Calculating a double declining balance is not complex although it. Double declining balance rate 2 x 20 40 The book value of the vehicle at the beginning of 2010 is 50 00000 The depreciation for the first year in 2010 is therefore. First Divide 100 by the number of years.

2 x basic depreciation rate x book value. To consistently calculate the DDB depreciation balance you need to only follow a few steps. Cost required argument This is the initial.

Content Double Declining Balance Depreciationdefined With Formula Calculation Examples Example Of Ddb Depreciation Double Declining Balance Depreciation Calculator Sum Of The. The double declining balance formula. The Double Declining Balance Depreciation Method Formula.

When using the double-declining balance method be sure to use the following formula to make your calculations. The Double Declining method calculates depreciation by multiplying the asset book value at the beginning of the fiscal year by basic depreciation rate and 2. Returns the depreciation of an asset for a specified period using the double.

Depreciation 2 Straight-line depreciation percent.

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Depreciation Method Youtube

Double Declining Balance Method Of Depreciation Accounting Corner

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Simple Tutorial Double Declining Balance Method Youtube

How To Use The Excel Ddb Function Exceljet

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation Formula Examples With Excel Template

Double Declining Balance Depreciation Daily Business

Double Declining Balance Depreciation Examples Guide

Double Declining Balance Method Of Deprecitiation Formula Examples

Accumulated Depreciation Definition Overview How It Works

What Is The Double Declining Balance Method Definition Meaning Example

Double Declining Depreciation Efinancemanagement

Double Declining Balance Depreciation Calculator

Double Declining Balance Depreciation In Excel 2020 Youtube

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula