Incremental margin formula

Breakeven point in units. Gross margin is the difference between revenue and cost of goods sold COGS divided by revenue.

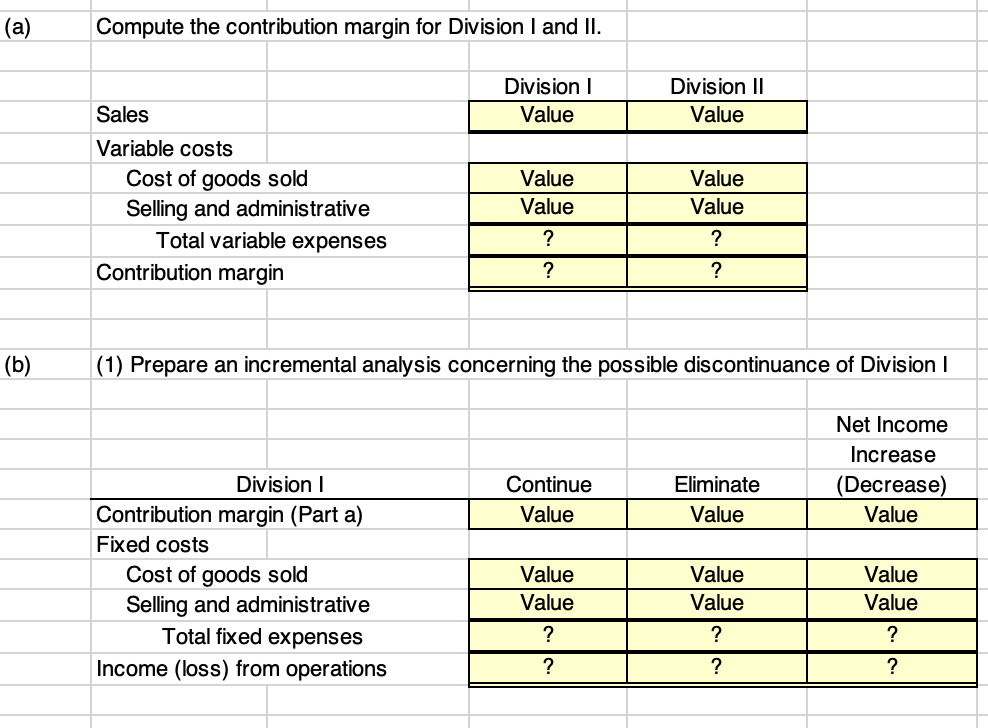

Solved P20 5a Prepare Incremental Analysis Concerning Chegg Com

Lets assume that the lead time is 4 days.

. Gross margin is expressed as a percentageGenerally it is calculated as the selling price of an item less the cost of goods sold e. Sleep apnoea machine giant Resmed has lifted its dividend after its full year net profit surged 64 per cent and it reaped a windfall of up to US70m 986m from a recall from rival Philips. This is less of a problem when in-house diners who order high-margin items such as wine and other alcoholic drinks help cover the costs of occupancy and labor.

Marginal profit is the profit earned by a firm or individual when one additional unit is produced and sold. Before calculating the variable margin you need to know the product or services sale price and the variable costs. Nevertheless a company with high wsm-tooltip headerOperating Leverage.

Alternatively the break-even point can also be calculated by dividing the fixed costs by the contribution margin. The net present value is the final cash flow that a project will generate potentially ie positive or negative returns. Buying a put option is a bet on less Selling is a bet on more.

To this cost a higher profit margin needs to be added to cover non-manufacturing overheads as well as to provide a satisfactory level of profit to the firm. 015 of gross margin. The marginal cost of production is the change in total cost that comes from making or producing one additional item.

But the business model is seriously threatened when in-house dining dwindles. The total fixed costs are 50k and the contribution margin is the difference between the selling price per unit and the variable cost per unit. The annual carrying cost is 150 the value is high because milk is a highly perishable product.

The company then. The final step is to calculate the marginal cost by dividing the change in total costs by the change in quantity. The last calculation using the mathematical equation is the same as the breakeven sales formula using the fixed costs and the contribution margin ratio previously discussed in this chapter.

We will determine your initial margin using a table of four incremental tiers. Whereas the internal rate of return is the discount rate at which the NPV becomes zero or reaches the break-even point Break-even Point In accounting the break even point is the point or activity level at which the volume of sales or revenue exactly equals. The formula uses a 365-day divisor for UK Singapore and South African shares and a 360-day divisor for shares in other markets.

Best Email Design. 8 change in revenue 1change in quantity 8. Marginal revenue will be 8 and you will ignore the average price of 15 60040 since MR is only concerned with the incremental change or the additional item sold.

Its not as useful when making incremental pricing decisions. Company Z produces 100 desks and sells them for 150 per unit to get 15000 in revenue. The question in an options trade is.

Marginal Cost Of Production. Selling price Rs 750. However only the portion.

The breakeven point in units may also be calculated using the mathematical equation where X equals breakeven units. Lets consider a 1L milk pack at 150 selling price sold with 10 margin ie. Once you have both of these figures use the following formula to calculate the variable margin.

Production or acquisition costs not including indirect fixed costs like office expenses rent or administrative costs then divided by the same selling. Profit margin 50 on manufacturing cost Rs 250. Variable margin formula.

The purpose of analyzing marginal cost is to. Price and Gross Margin 2017-2022 4 Global Infant Formula Foods Consumption by Region 41 Global Infant. But it earns a smaller profit on each incremental sale.

Which applicationend-user or product type may seek incremental growth prospects. Next the change in total costs and change in quantity ie. Total manufacturing costs Rs 500.

It can be further expanded as shown below Degree of Operating Leverage Formula Sales Variable cost Sales Fixed cost Variable cost Explanation. Production volume must be tracked across a specified period. For example selling price calculation may be as follows.

The margin rate will increase progressively as your aggregate position moves up from one tier to the next. Total Costs Total Fixed Costs Total Variable Costs. With fewer in-house diners delivery must cover a greater share of restaurants fixed operating costs.

Formula Contribution margin EBIT. It is the difference between marginal cost and marginal product also known as marginal. What will a stock be worth at a future date.

We assume that the stock-out cost is 3 time the gross margin that is to say 045. So after deducting 1000 from 2000 the contribution margin comes out to 1000.

Incremental Analysis Youtube

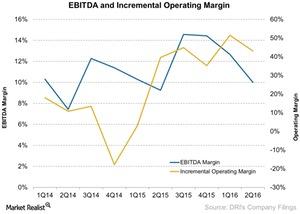

How Darden S Incremental Margins Have Expanded

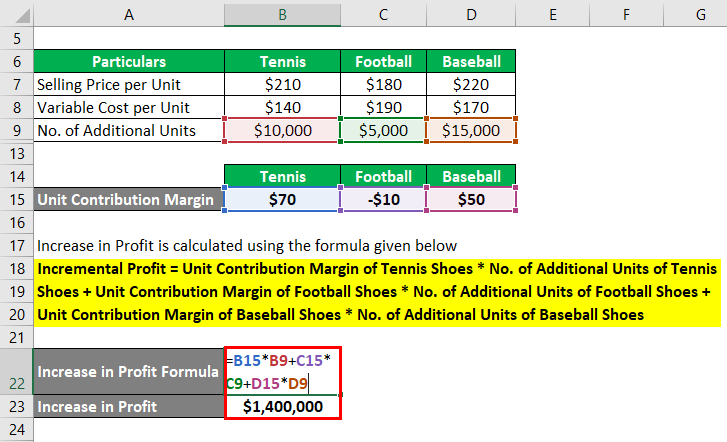

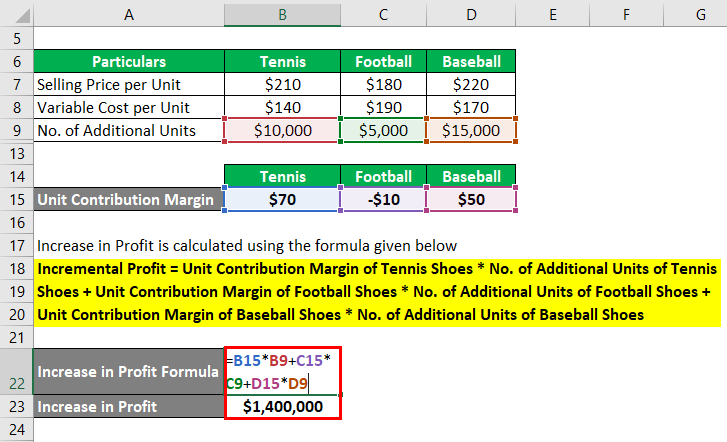

Unit Contribution Margin How To Calculate Unit Contribution Margin

Contribution Margin Formula And Ratio Calculator Excel Template

Chapter 6 Incremental Analysis Study Objectives Ppt Video Online Download

Contribution Margin Formula And Ratio Calculator Excel Template

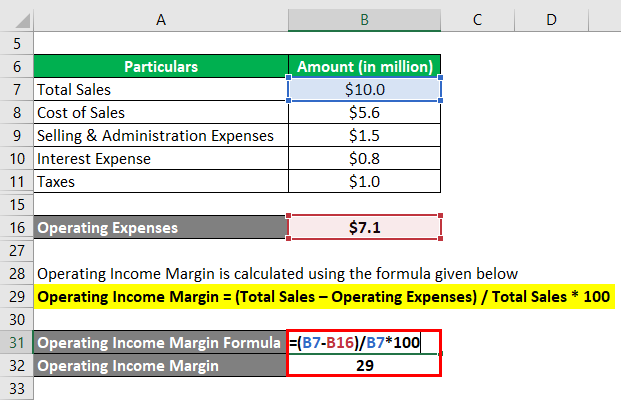

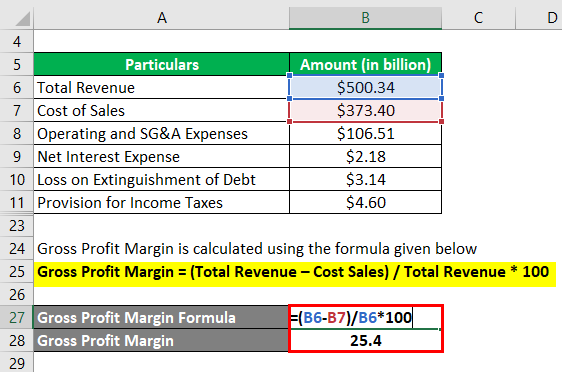

Profit Margin L Most Important Metric For Financial Analysis

Incremental Margin Formula And Profit Growth Analysis Calculator

Team Study

Profit Margin L Most Important Metric For Financial Analysis

Acct 2102 Sally Co Incremental Profit Analysis Class Activity Youtube

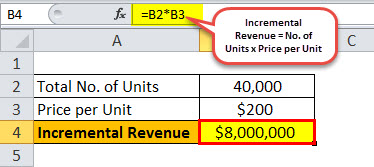

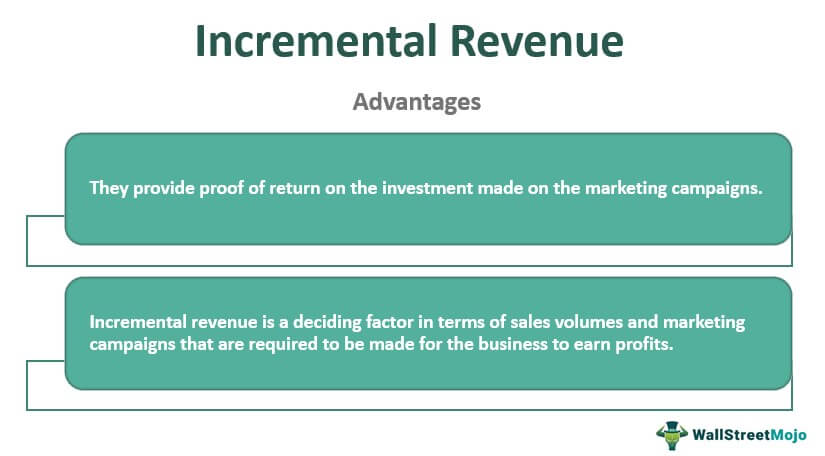

Incremental Revenue Definition Formula Calculation With Examples

Chapter 6 Incremental Analysis Study Objectives Ppt Video Online Download

Contribution Margin Formula And Ratio Calculator Excel Template

Incremental Margin Formula And Profit Growth Analysis Calculator

Incremental Revenue Definition Formula Calculation With Examples

Incremental Analysis Accounting Fifth Edition Ppt Download